Very Excited About Our Tulips This Year

In front of our house there is a little round planter area which is full of tulip bulbs. They’ve done really well this year, as you can see from the picture to the right. They’ve created this lovely riot of pink blooms, with some red thrown in for highlight, which you can admire every time you step out front.

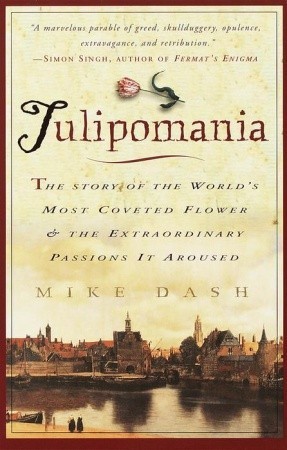

They reminded me of this book I read a while back, called Tulipomania, about the infamous tulip bulb market bubble in the Netherlands in the 17th century. The book starts with a history of the tulip, which originated in the steppes of Central Asia, coming to Europe via the Ottoman Empire. It’s a very hardy plant, able to tolerate extreme cold and dry weather. We certainly don’t put any effort into caring for ours; it’s like they just obligingly come up every spring to give us a show.

As for the tulip mania of the 1630s, well, it’s possibly the best known example of a market bubble in economic history, though there have certainly been others. As the book explains, a market bubble occurs when a good is artificially priced much higher than its actual worth. Supposedly, according to economic theorists, markets will naturally adjust prices based on supply and demand. These theorists are assuming that people behave rationally, and pay for stuff based on its worth to them, relative to other options. However, it might not be correct to assume that people are always rational, as a survey of history will reveal.

The story of tulip mania is an interesting one. It seems that before the bubble, and after it as well, there was a market for rare bulbs that produce exquisitely beautiful, multicolored tulips. The variegated patterns on these flowers are the result of a virus, which can be preserved in a bulb when it is propagated by division. So it was possible, though very difficult, to breed these rare tulips, and tulip connoisseurs were very interested in acquiring these bulbs; hence their high prices. They were like luxury tulips.

Somehow, when the general public got wind of how much these bulbs were selling for, they decided they wanted in on the racket. Of course, they couldn’t all buy these rare bulbs, since by definition there aren’t many of a rare thing, so they just bid up the prices of the common tulip bulbs. You know, the boring red and yellow and purple ones that you can see filling fields in the Netherlands if you do a quick image search. These shouldn’t be worth a whole lot of money; they’re a basic commodity, like potatoes. But somehow the Dutch masses convinced themselves they were all tulip bulb brokers and these common items soared in price. It was a classic case of “irrational exuberance.”

The bubble didn’t last too long, because the fundamental value of the ordinary tulip varieties simply did not justify the high prices. That’s what makes an asset price bubble a bubble; sooner or later the exuberance wears off, and the holders of the asset who bought it for its inflated price can’t offload it for a profit. Demand for the asset drops sharply, and pop! goes the bubble. The asset owners are stuck “holding the bag,” as they say. They get wiped out.

What stands out about tulip mania is how plainly it is an example of a price bubble, since it involves a basic commodity, and the price inflation was so disproportionate to what one would think was a rational expectation. I mean, surely the farmers who were selling their bulbs at these inflated prices knew they were ripping off the speculators, right? Were they being immoral? Arguably, they were being rational – any given farmer would know that if they didn’t sell their bulbs to someone willing to pay so much, some other farmer would. Any given speculator knew that if they didn’t buy and flip some bulbs, some other speculator would, and reap the profits. It was a case of herd psychology, everyone just playing along with the madness.

A similar herd psychology is at work in the kinds of bubbles that most commonly affect our lives, which are in the stock market, such as the dot-com bubble, or in real estate, such as the 2000s housing bubble. When credit is easy and exuberance is high, everyone just kind of goes along with the trend of rising valuations and carefree spending. No one wants to spoil the party. If you’ve seen the movie The Big Short, you know that the guys who saw that the housing bubble was going to burst were going against conventional thought. When the bubble did burst, it was hard to pin the blame on anyone. I mean, you could single out obvious actors, like the credit rating agencies in the case of the 2000s housing bubble, but can you prove they were guilty of fraud, and not just of herd mentality? No, you can’t.

I think this kind of mania is possible because, ultimately, money and the value of stuff is a fiction in our collective heads. If we all agree that a digital coin is worth ten thousand bucks, that’s what it’s worth. If later on we all agree that it’s worth a hundred bucks, it becomes worth that much, and too bad for you if that’s all you’re invested in. We could even all agree that the tulip bulbs in our front yard are worth ten thousand bucks apiece! Just venmo me and they’re yours.

One thought on “Very Excited About Our Tulips This Year”

I have been informed by Aileen that these tulips were planted by the previous owner of the house, Mrs. Whitman. So they are officially “Mrs. Whitman’s tulips.”

Also, the red ones are apparently “multilobed tulips,” at least that’s what I got out of Google Lens.